NTPIC meets leading tax advisory firms and professional bodies to harmonize Nigeria’s tax reforms and ensure effective implementation

The National Tax Policy Implementation Committee (NTPIC) has continued its stakeholder engagement program, holding a high-level consultative session with leading tax advisory firms, professional bodies, and institutional representatives to support the effective rollout of Nigeria’s newly enacted tax laws.

Also read: Onitsha Market traders protest one-week closure by Soludo

The session included national presidents of professional bodies and leading tax partners from advisory firms.

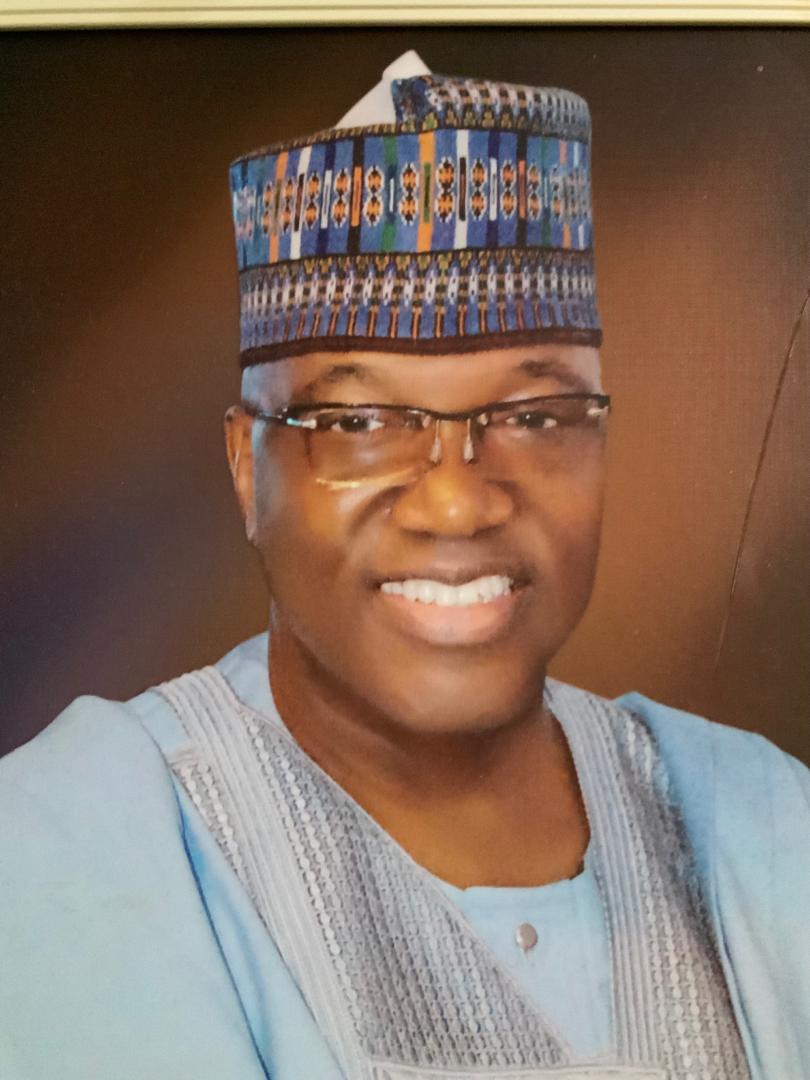

NTPIC Chairman, Mr. Joseph Tegbe, highlighted that the success of tax reforms relies more on effective change management than on policy design alone.

He stressed the importance of clear communication and public trust, and confirmed the Committee’s commitment to engaging sub-national governments through the Joint Revenue Board to harmonize interpretation, build capacity, and ensure alignment across federal and state tax administrations.

Participants welcomed the reforms, describing them as structural and focused on strengthening Nigeria’s fiscal framework rather than generating short-term revenue.

They emphasized the need for consistent interpretation across institutions and clear operational guidelines to prevent fragmented enforcement.

They also recommended coordinated public education strategies that clarify how the reforms affect individuals, small businesses, and corporates while reinforcing principles of fairness, proportionality, and national development.

Mr. Tegbe concluded by thanking participants for their engagement and reaffirmed the Committee’s commitment to structured consultation and timely resolution of concerns.

Also read: Femi Adebayo eviction explained amid bank foreclosure

The meeting included Barrister Ismael Ahmed, Chairman of the Stakeholder Engagement Subcommittee; Mr. Ajibola Olomola, Chairman of the Technical Subcommittee; and members of the NTPIC Secretariat.