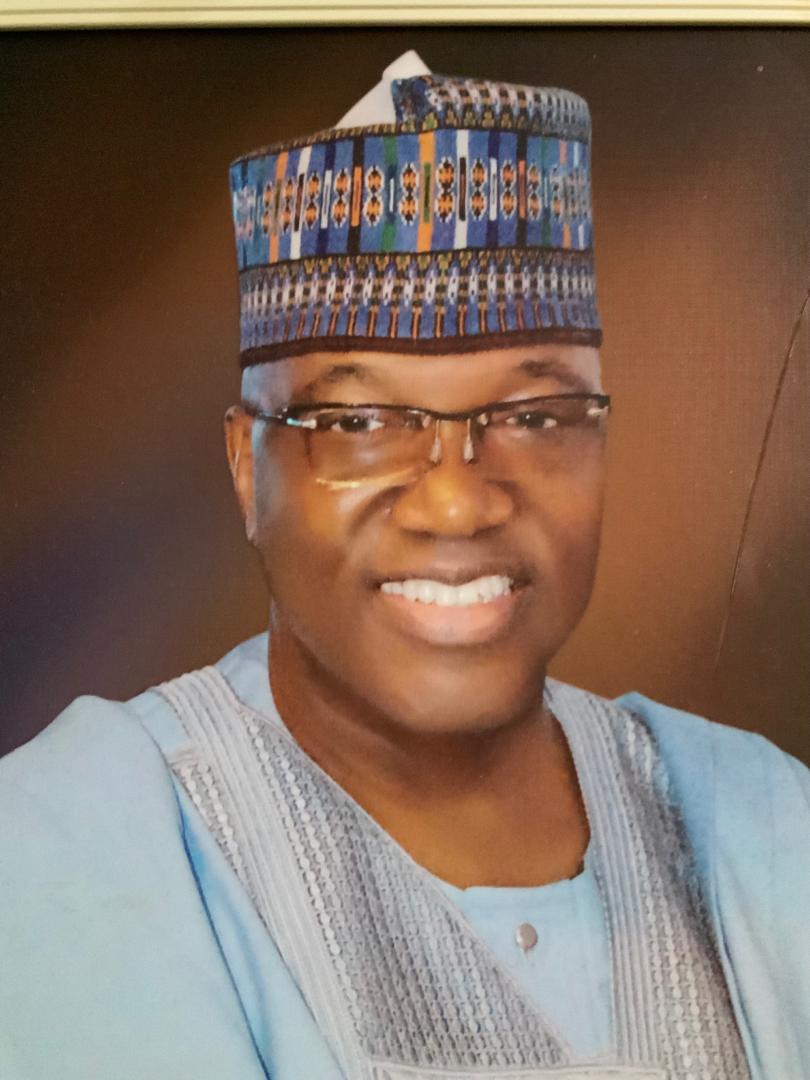

Nigeria has no effective system to tax informal businesses, says revenue chief Zacch Adedeji, stressing formalisation as the only sustainable solution

Chairman of the Nigeria Revenue Service, Dr Zacch Adedeji, has said Nigeria currently lacks any effective framework to directly tax operators in the informal sector, noting that existing tax laws are designed primarily for the formal economy.

Also read: NTPIC engages tax advisory firms to strengthen Nigeria’s tax reforms

Speaking on the implementation of the country’s newly enacted tax laws, Dr Adedeji explained that informal businesses operate outside structured regulatory systems and can only be taxed sustainably through deliberate formalisation.

Dr Adedeji said encouraging informal operators to register, grow, and operate within recognised frameworks remained the only viable pathway to expanding the tax net.

“On the informal sector, you cannot tax what is informal,” Dr Adedeji said.

“To tax them, you must first formalise them. Once they are formal, they fall into proper categories and can be taxed accordingly.”

He said the Nigeria Revenue Service was prioritising education, engagement and stakeholder outreach, with dedicated departments focusing on media relations and engagement with small and medium sized enterprises.

According to Dr Adedeji, the objective is to support business growth rather than suppress enterprise, describing revenue collection as a partnership rather than an enforcement campaign.

Addressing public concerns over Value Added Tax, Dr Adedeji rejected claims that VAT disproportionately affects low income earners, stating that the Nigeria Tax Administration Act 2025 was deliberately structured to protect the poor through exemptions and targeted reliefs.

He said VAT remains a consumption tax with safeguards in place, adding that under the new tax regime only income or profit is taxed, not capital or personal assets.

Dr Adedeji said recent reforms had restored clarity and accountability in tax administration, supported by improved technology and streamlined processes that enhance transparency and revenue tracking.

On compliance, he assured businesses that no company would be shut down solely for tax non compliance, stressing that audits are now integrated into routine operations to guide businesses rather than punish them.

“If a business does not make profit, there is nothing to tax,” he said, adding that sustaining enterprise growth was essential to long term revenue generation.

Dr Adedeji also confirmed that the controversial tax credit scheme had been discontinued due to abuse and because it placed tax authorities in the role of infrastructure supervisors, which he said fell outside the agency’s mandate.

He described VAT reforms as a powerful driver of increased fiscal transfers to state governments and said the exemption of food and agricultural items from VAT was aimed at curbing food inflation and protecting household welfare.

Dr Adedeji identified information gaps and public trust as key challenges facing tax reform implementation, stressing that transparency and openness were central to rebuilding confidence in government.

“Trust is critical,” he said.

“People must believe government is not trying to make life harder.”

He also dismissed fears that individual bank balances could be taxed, describing such claims as unfounded and inaccurate.

“Your bank account is your asset,” Dr Adedeji said. “Money in your account does not automatically mean profit.”

Also read: Citizen monitors demand probe over alleged 2025 tax law forgery

He concluded that sustainable revenue growth depends on creating a conducive business environment, insisting that transparency, rule of law and accountability would remain non negotiable under his leadership.